does cash app report to irs for personal use

The American Rescue Plan includes language for third party payment networks to change the way. Here are some facts about reporting these payments.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Cash App wont report any of your personal transactions to the IRS.

. Nothing to do with the transfer method currency etc. Any errors in information will hinder the direct deposit process. This is far below the previous threshold of 20K.

Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report. 2022 the rule changed. As of January 1 the IRS will change the way it taxes income made by businesses that use Venmo Zelle Cash App and other payment apps to receive money in.

A business transaction is defined as payment. Some businesses or sellers who receive money through cash apps may not have been reporting all the income. Updated 316 PM ET Mon January 31 2022.

If you receive a suspicious social media message email text or phone call regarding the Cash App or see a phone number that you believe is. The IRS plans to take a closer look at cash app business transactions of more than 600. The Composite Form 1099 will list any gains or losses from those shares.

If you did not sell stock or did not. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service.

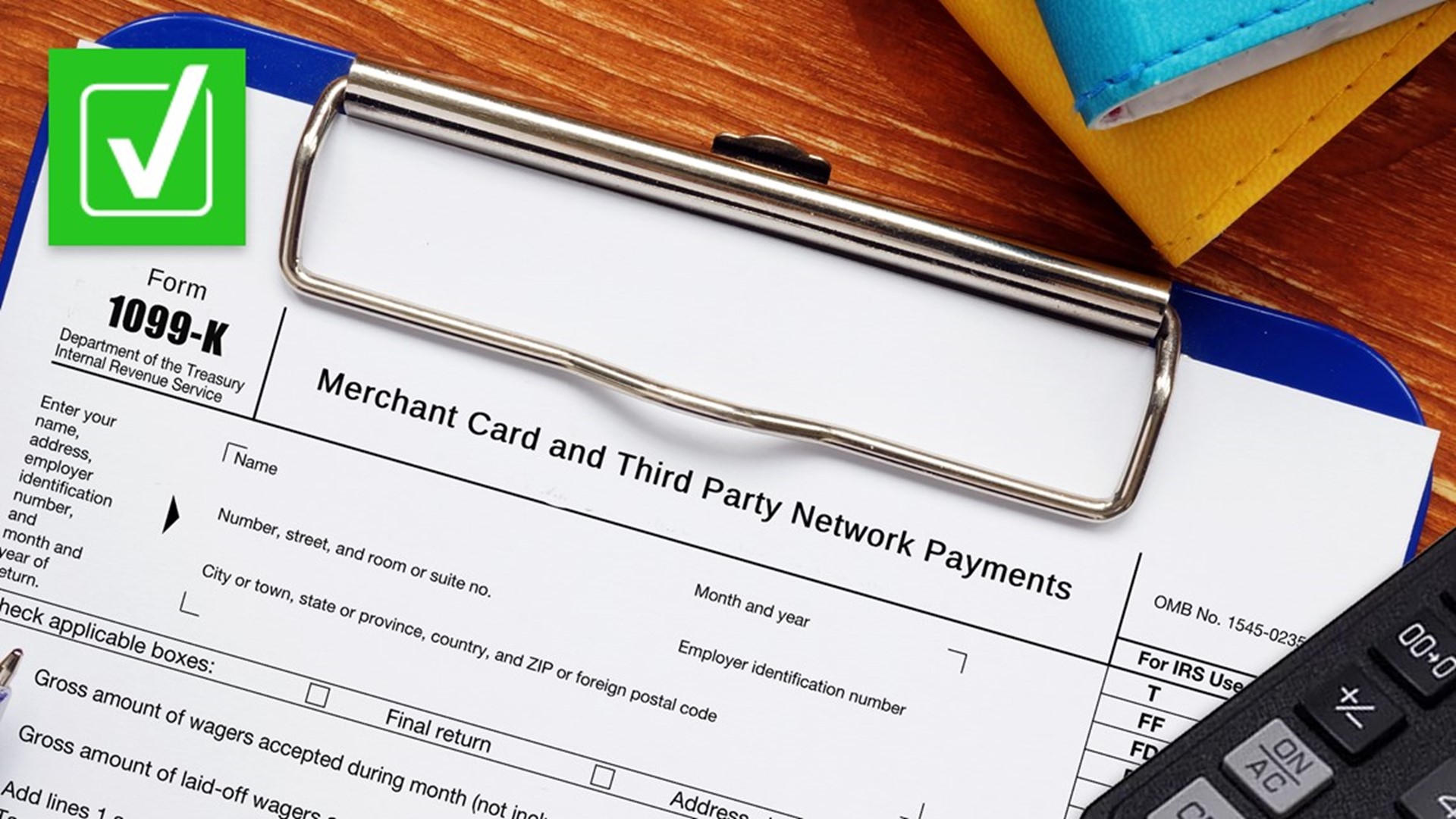

According to the Cash App website certain accounts receive 1099 tax forms. Only customers with a Cash for Business account will have their transactions reported to the IRSif their transaction activity meets reporting thresholds. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service.

However in Jan. Previously those business transactions were only reported if they were more than 20000 at the end. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600 annually.

How do these changes affect you. To view your tax documents. A new law requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS.

Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps. The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to report aggregate business transactions of 600 or more to the IRS. What does this mean say I received 50k on cash app for my personal account do I got to pay taxes on that money and will I get a tax for because what if u dont have history of all transactions.

Can you report on cash App. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your. Whos covered For purposes of cash payments a person is defined as an individual company corporation partnership association trust or estate.

Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. Yes you can use cash app for the tax refund deposit. By lowering the reporting threshold from 20000 to 600 the IRS will get that transaction information from the cash app platform.

Cash App Investing will provide an annual Composite Form 1099 to customers who qualify for one. Under the original IRS reporting requirements people are already supposed to. As part of the American Rescue Plan Act cash apps will now report commercial income over 600.

Users with Cash App for Business accounts that accept over 20000 and more than 200 payments per year will receive a. A new rule will go into effect on Jan. The IRS wants to make sure theyre getting their cut of taxes.

PayPal Venmo and Cash App to report commercial transactions over 600 to IRS. You need to pay taxes on your income. 1250 PM EDT October 16 2021.

Tap the profile icon on your Cash App home screen. If you have a standard non-business Cash App account you dont need to worry about Form 1099-K. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for the change some claiming a new tax would be placed.

Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. If you use cash apps for personal use you wont be impacted but where the line gets blurry is when self-employed workers may use the same cash app account for personal and business transactions. IRS Tax Tip 2019-49 April 29 2019 Federal law requires a person to report cash transactions of more than 10000 to the IRS.

Select the 2021 1099-B. As long as your account is under your real name and correct address. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

So now apps like Cash App will notify the IRS when transactions get up to 600. 1 2022 users who send or receive more than 600 on cash apps must report those earnings to the IRS.

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Organization Solutions

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

What Churches Need To Know About Venmo Paypal And Cash App Changes Outreachmagazine Com

Does The Irs Want To Tax Your Venmo Not Exactly

Changes To Cash App Reporting Threshold Paypal Venmo More

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

New Tax Legislation Will I Get Flagged By Irs If I Receive Over 600 On Cash Apps Wfla

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Does The Irs Want To Tax Your Venmo Not Exactly

Reporting 600 Cash App Transaction To The Irs New Tax Law Explained Answering Questions Youtube

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

![]()

Tax Reporting With Cash For Business

Irs Has New Ways Of Taxing Cash App Transactions

Tax Changes Coming For Cash App Transactions

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas